Securities

Securities laws are designed to protect investors from fraudulent or manipulative practices and to provide investors with the information necessary to make informed investment decisions.

Since the Securities and Exchange Commission (SEC) was established in 1934, the Commission has been tasked with a three-part mission: protecting investors; maintaining fair, orderly, and efficient markets; and facilitating capital formation. Since 2018, the SEC has spent substantial time and resources on important questions about how the securities laws apply to the crypto ecosystem. Many of these questions are complex and difficult, especially because the securities laws — which generally mandate the presence of intermediaries — are a poor fit for crypto, which has decentralization and disintermediation at its core.

Unfortunately, many of these questions remain unanswered. One issue that has created significant confusion is whether and when digital assets constitute “investment contracts” and therefore should be regulated as securities. The SEC has not given guidance on this issue since 2019, instead resorting to a practice known as “regulation by enforcement,” in which the SEC has accused upstanding US companies of securities violations without adequately explaining its views on the law.

In addition to uncertainty regarding which assets are classified as securities, there are many other unresolved issues related to how the securities laws apply in the crypto context. For example, the SEC has refused to approve applications from registered securities exchanges to list a spot bitcoin exchange-traded product (ETP) despite approving bitcoin futures ETPs. We support policies that clarify rather than confuse the application of existing laws, as well as policies that embrace rather than reject the unique nature of crypto through the development of new, tailored rules and requirements.

Relevant News

Bloomberg Crypto: Blockchain Association Sues SEC

Blockchain Association and Crypto Freedom Alliance of Texas File Lawsuit Challenging SEC’s Unlawful “Dealer Rule” that Threatens American Industry and Innovation

Blockchain Association Statement on the Partial Dismissal of the SEC’s Action Against Coinbase

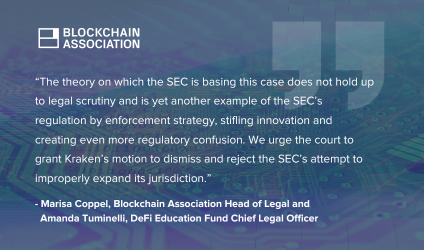

Blockchain Association Files Amicus Brief in SEC v. Kraken

Politics Around Crypto Are Shifting: Blockchain Association CEO

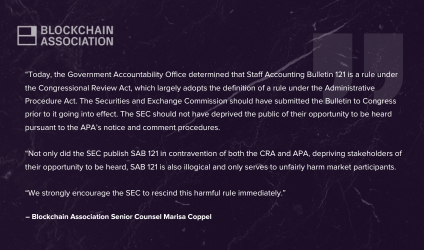

Blockchain Association Statement on GAO Decision on SAB 121

Blockchain Association Public Comment on Safeguarding Advisory Client Assets

“This is a huge win not just for Grayscale but the broader crypto community,” says Blockchain Association’s Kristin Smith

Blockchain Association files amicus brief in Coinbase v. SEC

Blockchain Association Calls for Investigation into SEC Approval of Prometheum Ember Capital as Special Purpose Broker-Dealer

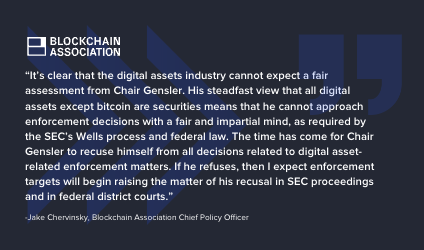

SEC Chair Gensler Must Recuse Himself From Crypto Enforcement Decisions

Blockchain Association Publishes Paper Outlining Legal Case for SEC Chair Gensler’s Recusal

Chair Gensler Must Recuse Himself From Digital Asset Enforcement Decisions

Blockchain Association Submits Additional Comments to SEC in Response to Proposed Rulemaking to Amend the Definition of Exchange

Blockchain Association Files Amicus Brief in SEC Lawsuit Against Ishan Wahi

Blockchain Association Files Amicus Brief in SEC Lawsuit Against Ripple

Blockchain Association Files Amicus Brief in Support of Grayscale Investments’ Lawsuit Against the SEC

SEC’s regulatory approach chills innovation and may send crypto overseas