Decentralized Finance

Decentralized finance (DeFi) uses blockchain-based software protocols to create a new, programmable financial system that allows users to conduct their economic lives without relying on banks or other institutions.

The purpose of DeFi is to reinvent the financial services that centralized intermediaries have traditionally offered by distilling them into their component rules and procedures and converting them into autonomous code that self-executes on a public blockchain. This way, DeFi can allow anyone, anywhere, to access financial services without giving up custody and control of their assets or sensitive personal data.

DeFi seeks to modernize the outdated infrastructure underlying the global financial system and bring it into the digital age. DeFi achieves that goal by enabling financial activities without the need for slow, expensive, and sometimes discriminatory gatekeepers and middlemen. In the process, DeFi can also reduce or eliminate many of the risks introduced by those intermediaries in the legacy financial system, and make it easier for regulators to audit, evaluate, and oversee financial markets. Yet, because DeFi is so new and so different from traditional finance, it raises many questions about the application of existing laws and the need for new regulations tailored to the DeFi context. We support US policies that encourage innovation in this promising sector and ensure that American companies and citizens can enjoy all the benefits and opportunities it has to offer.

Relevant News

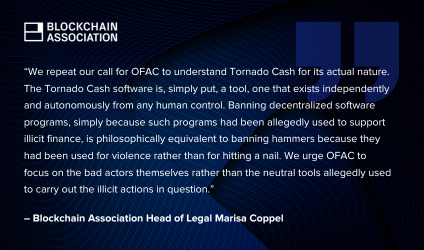

Blockchain Association Files Second Amicus Brief in Coin Center v. Treasury

Blockchain Association Public Comment on IOSCO’s Consultation Report on Policy Recommendations for Decentralized Finance (DeFi)

Crypto rights are fundamental American rights

Blockchain Association Calls for Revisions to the Digital Commodities Consumer Protection Act (DCCPA)